Bank anywhere, any time; there's an app for that! Enjoy the convenience and ease of accessing your UMB accounts via your smart phone in more ways than one. No matter what method you choose for your mobile banking, we are ready.

Mobile Browser and App features:

- Balance Inquiry

- Transaction history

- Transfer funds between UMB accounts

- Bill Pay

- Branch locations and ATMs search

- Mobile Deposit*

- eStatements (enrollment & statement viewing)

- Account alerts

- Check Stop Payments (Takes you to the same web experience to stop payments that is available in Online Banking.)

To enroll in mobile banking, you must first enroll in Online Banking or already be enrolled in Online Banking.

Free Mobile App:

For iPhones visit the Apple/iTunes App store, or visit Google Play for Android Phones. Search for United Mississippi Bank.

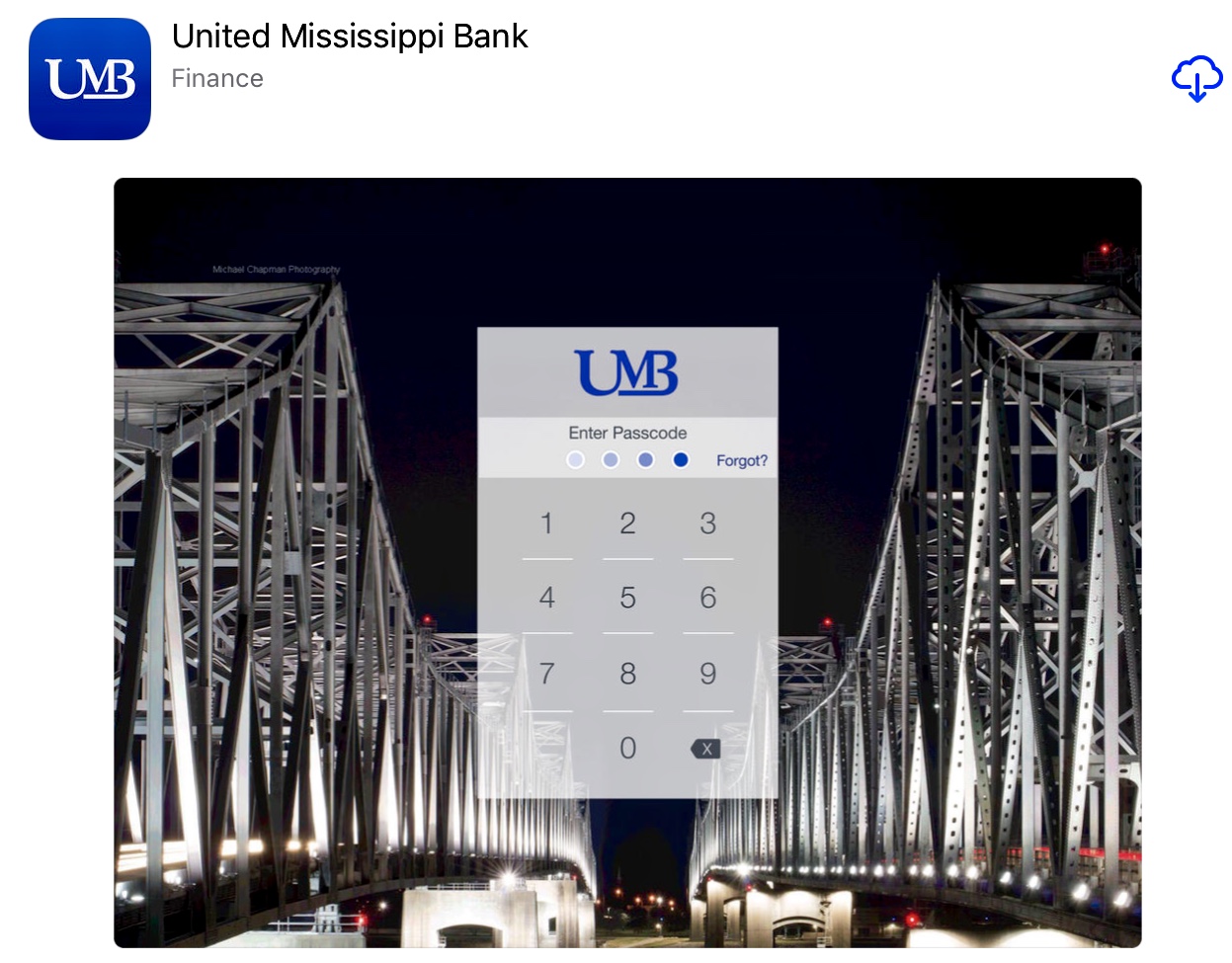

Here's what you should find in the App Store for Apple devices:

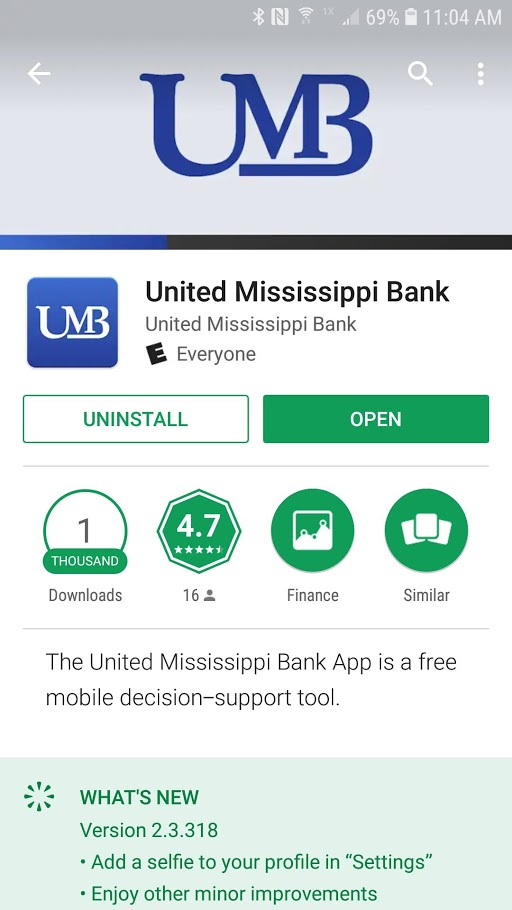

Here's what you should find at Google Play for Android devices.

Once you've installed the app:

- Touch the app icon on your home screen.

- Enter your online bank account information to log in.

- Create a four-digit passcode for added security when prompted. This passcode will be required each time you launch the app.

Mobile Deposit Services

Personal accounts may be enrolled for mobile deposit services but are subject to approval.

Daily and monthly $ limits are applicable per account. The standard daily limit is $2,000 with a monthly limit of $5,000. Consideration for limit increases may be requested through your account officer as needed.

Restrictions Apply. Refer to the Mobile Banking Agreement and Disclosure for more details. Mobile Deposits approved prior to 6:00 PM CST each business day will be made available the following business day. Mobile Deposits approved after 6:00 PM CST each business day will be made available on the second business day following the deposit. Funds availability may be delayed or withheld if item is suspect for any reason as Regulation CC does not apply to items deposited via Mobile Deposit.

Mobile Deposit Instructions:

- Endorse the check. Endorsement must include:

- For UMB Mobile Deposit Only (on first line), and

- Authorized signature of check payee

- Log into UMB Mobile App and select Deposit Check option from the Dashboard menu

- Select Deposit a Check, enter the check amount, and then select Continue.

- Choose the proper deposit account from the listing of enrolled accounts.

- You will be prompted to take a picture of front and back of check (place on flat, dark surface in even light and capture all four corners of the check)

- After validating the displayed information (check amount, deposit account# and the front and back images), select Submit.

- You will see Deposit Received when your deposit is complete. If you receive an error message before Deposit Received, please follow the prompts given.

- After your deposit is complete, mark the check as “Deposited”, then keep it in a secure place for 15 business days, pending final verification.

- After 15 business days following the deposit, once you have verified that the funds have been credited to your account, mark the check as “Void” and dispose of it in a secure manner, such as shredding, to ensure it is not presented for deposit again.

Mobile Deposit Confirmations:

When you submit your Mobile Deposit, you will receive an email notification regarding the status of your Mobile Deposit. Please be advised that if you receive an approved email notification regarding your deposit, the deposit is still subject to rejection during processing if the item is determined to be ineligible for processing for any reason. You will receive an additional email notification should this occur. You must maintain a valid email address in online banking to ensure you receive your email notifications.

Mobile Deposit Check Storage:

Once you have deposited a check into your account using Mobile Deposit, mark it as Deposited, then keep it in a secure place for 15 business days, pending final verification. After 15 business days following the deposit, once you have verified that the funds have been credited to your account, mark the check as Void and dispose of it in a secure manner, such as shredding, to ensure it is not presented for deposit again.